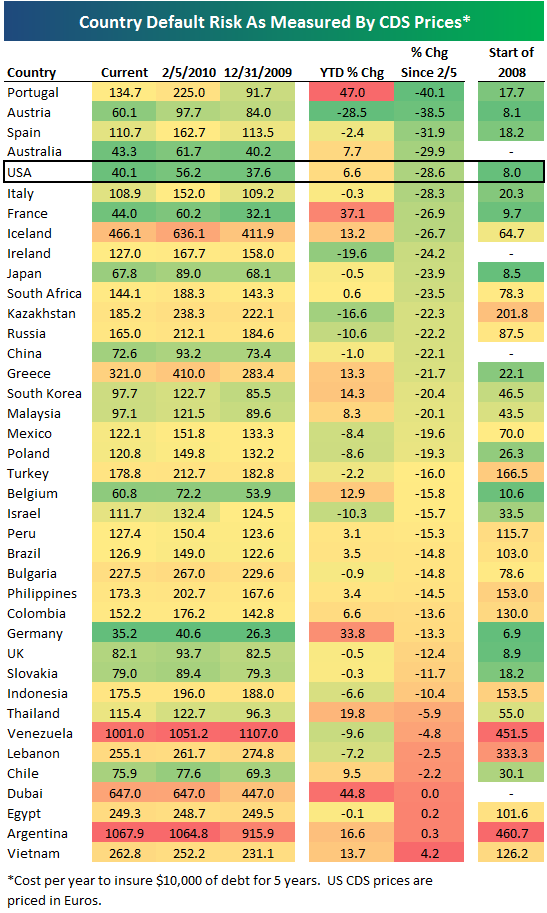

La febbre greca si abbassa leggermente e così il costo dell'assicurazione contro il default del debito sovrano

si abbassa un po' ovunque come non mancano di sottolineare gli analisti di Bespoke: ecco come si sono mossi i prezzi dei CDS a 5 anni negli ultimi mesi

utilizzare il loro prezzo come proxy della probabilità di default ma ci sono parecchie precauzioni da prendere:

questo articolo del New York Times discute la possibilità di una minibolla nei CDS:

Last September, the company, the Markit Group of London, introduced the iTraxx SovX Western Europe index, which is based on such swaps and let traders gamble on Greece shortly before the crisis. Such derivatives have assumed an outsize role in Europe’s debt crisis, as traders focus on their daily gyrations.A result, some traders say, is a vicious circle. As banks and others rush into these swaps, the cost of insuring Greece’s debt rises. Alarmed by that bearish signal, bond investors then shun Greek bonds, making it harder for the country to borrow. That, in turn, adds to the anxiety — and the whole thing starts over again.

On trading desks, there is fierce debate over what exactly is behind Greece’s recent troubles. Some traders say swaps have made the problem worse, while others say Greece’s deteriorating finances are to blame.

On trading desks, there is fierce debate over what exactly is behind Greece’s recent troubles. Some traders say swaps have made the problem worse, while others say Greece’s deteriorating finances are to blame. “This is a country that is issuing paper into a weakening market,” said Ashish Shah, co-head of credit strategy at Barclays Capital, referring to Greece’s need for continual borrowing.

But while some European leaders have blamed financial speculators in general for worsening the crisis, the French finance minister, Christine Lagarde, last week singled out credit-default swaps. Ms. Lagarde said a few players dominated this arena, which she said needed tighter regulation.

Trading in Markit’s sovereign credit derivative index soared this year, helping to drive up the cost of insuring Greek debt, and, in turn, what Athens must pay to borrow money. (...)

European banks including the Swiss giants Credit Suisse and UBS, France’s Société Générale and BNP Paribas and Deutsche Bank of Germany have been among the heaviest buyers of swaps insurance, according to traders and bankers who asked for anonymity because they were not authorized to comment publicly.

That is because those countries are the most exposed. French banks hold $75.4 billion worth of Greek debt, followed by Swiss institutions, at $64 billion, according to the Bank for International Settlements. German banks’ exposure stands at $43.2 billion. (...)

Markit says its index is a tool for traders, rather than a market driver.

In a statement, Markit said its index was started to satisfy market demand, and had improved the ability of traders to hedge their risks. The index and similar products, it added, actually make it easier for buyers and sellers to gauge prices for instruments that are traded among players over the counter, rather than on exchanges.

“These indices have helped bring transparency to the sovereign C.D.S. market,” Markit said. “Prior to their creation, there was no established benchmark index enabling investors to track the performance of segments of the sovereign C.D.S. market.”

Personalmente trovo che la posizione di Markit sia sotenibile, pur continuando a pensare che questo sia un

mercato da regolamentare. Più in generale tuttavia non penso che si possa escludere a priori la formazione di bolle anche nei CDS. In questi mesi però la preoccupazione per il debito sovrano mi sembra più giustificata dall'oggettivo aumento del rischio paese creato dalla deterioramento del debito pubblico per combattere la grande contrazione del 2007-2008 (e speriamo che di contrazione si possa conrinuare a parlare e non di depressione). Proprio oggi il New York Times con un editoriale che parte proprio da questo tipo di considerazioni prende una posizione netta sulla regolamentazione dei CDS. Eccone un ampio stralcio:

Here are some of the problems that must be fixed:

NO TRANSPARENCY Derivatives are supposed to reduce and spread risk. In a credit default swap, for instance, a bond investor pays a fee to a counterparty, usually a bank, that agrees to pay the investor if the bond defaults. But because the markets in which they trade are largely unregulated, derivatives can too easily become tools for dangerous risk-taking, vast speculation and dodgy accounting.

A big part of the problem is that derivatives are traded as private one-on-one contracts. That means big profits for banks since clients can’t compare offerings. Private markets also lack the rules that prevail in regulated markets — like capital requirements, record keeping and disclosure — that are essential for regulators and investors to monitor and control risk.

That is why it is so essential to move derivative trades onto fully transparent exchanges. The administration originally embraced that idea, with exceptions only for occasional, unique contracts. But when the Treasury proposed legislation in August, it included huge loopholes, and a derivative reform bill that passed the House in December has many of the same problems. (The Senate has yet to introduce a reform bill.)

Both the administration and the House would exclude from exchange trading the estimated $50 trillion market in foreign exchange swaps — similar to the derivatives Greece used to hide its debt. The rationale for the exclusion never has been clearly explained.

The Treasury proposal and House bill also would exclude transactions that occur between big banks and many of their corporate clients from the exchange trading requirement, ostensibly because those deals are only for minimizing business risks, not for speculation or for window-dressing the books. That’s debatable. But even if true, other derivatives users would almost inevitably find ways to exploit such a broad exemption.

What is clear about the exemptions is that they would help to preserve banks’ profits. What is also clear is that they would defeat the goals of reform: to lower risk, increase transparency and foster efficiency.

LIMITED POWER TO STOP ABUSES When the House put out a draft of new rules in October, it sensibly gave regulators the power to ban abusive derivatives — ones that are not necessarily fraudulent, but potentially damaging to the system. Derivatives investors who stand to make huge profits if a company or country defaults, for example, might try to provoke default — a situation that regulators should be able to prevent. In the final House bill, however, the ban was replaced with a requirement that regulators simply report to Congress if they believe abuses are occurring.

NO STATE REGULATION, EITHER Current law also exempts unregulated derivatives from state antigambling laws. That means that states have no power to police their use for excessive speculation. Treasury and House reform proposals have called for maintaining the federal pre-emption of state antigambling laws. Pre-emption could be tolerable if derivatives were traded on fully regulated exchanges. But as long as many derivative products and transactions are exempted from fully regulated exchange trading, pre-emption of state antigambling laws is a license for, well, gambling.

•

The big banks claim that derivatives are used to hedge risk, not for excessive speculation. The best way to monitor that claim is to execute the transactions on fully regulated exchanges, pass rules and laws to ensure stability, and appoint and empower regulators with independence and good judgment to enforce compliance. Without effective reform, the derivative-driven financial crisis in the United States that exploded in 2008, and the Greek debt crisis, circa 2010, will be mere way stations on the road to greater calamities.

Il numero in edicola dell'Economist analizza le cause della debolezza della sterlina, ancora più

malmessa dell'euro. Nella sua ultima newsletter Shahin Shojai, del Capco Institute

malmessa dell'euro. Nella sua ultima newsletter Shahin Shojai, del Capco Institute

si interroga su come prevenire le crisi valutarie. L'ho trovata interessante e la riproduco qui con il permesso

del suo autore.

Can currency crises be prevented?

Shahin Shojai, Global Head of Strategic Research, Capco

In the past few days, both the Euro and Sterling have come under tremendous pressure from the investment community. Both have lost ground on the dollar, a currency that only 5 months ago was deemed unfit for purpose. Back then, in my commentary entitled “Why so much talk about the demise of the dollar when there are much more important issues to worry about?” I suggested that the talk about dollar’s demise was way over exaggerated and that it would be literally impossible to replace it as the currency of choice for pricing most commodities by a basket of currencies, due to the practical issues of conversions, and certainly the Chinese Yuan. I also suggested that if any currency was to replace the dollar it would have been the overpriced Euro, and even that was nothing more than a dream, and that the world had much more important things to worry about than finding a replacement for the dollar.Well, 5 months have passed and we see that as most people felt even during the booming years of the Euro-zone, it is very hard to manage an economic union with so many self-interests and no political union. The Euro-zone is not even remotely similar to the U.S. I have yet to meet an American that considers him/self a Californian or Texan, more than American. But, just ask how the French feel about their brethren in Belgium or even Spain. This is a union of nations that don’t always like each other, and when given the chance look for ways to take as much money from each other as they can. If you don’t believe me just look at the discussions that took place a couple of years ago on the common agricultural policy, and the French position. So, what took place in Greece is no surprise to anyone. What is of surprise is the reaction of the governments to the attack on the Euro. While, most believe that the Euro is overvalued, they still do not want to allow market forces, irrespective of whether the motivation is greed on the part of hedge funds or simply a need for a correction, to take their course. All are looking for ways to stop hedge funds from shorting Greek government debt and are forcing them to divert their attention onto the Euro, with the hope that with the aid of some kind of legislation they can stop them from pushing the Euro down further.

The truth of the matter is that, as my mentor the late Franco Modigliani used to say, the easiest way to avoid a run on a currency is for there to be perfect collaboration between that currency’s central bank and the central banks of the currencies that are being bought. This is what stopped George Soros from repeating what he did to the Pound to the French Franc. The unwavering willingness of the Bundesbank to accept Francs and hold them in return for Deutschemarks. If you don’t have such an agreement then there is no way of stopping such trends. Now, everyone is feeling that the Euro should fall because of a myriad of reasons that were completely ignored only a few weeks ago. And, it really does not matter if there is any logic to the action. All that matters is that it has now become a trend that few can afford to ignore. The same is true for Sterling. God knows who came up with the notion that there could be a hung parliament in the U.K., it certainly was not the Conservatives or the Labour party. If it was the Liberal democrats, then this is the first time that anyone outside their party has listened to them for the past 100 years. But, the fact is that in financial markets people look for explanations of what happens, which is then used by others to justify why they are following the herd. It is not the reasons that cause the markets to take certain actions, it’s the other way round.

Consequently, now that the world is feeling that the Euro and Sterling should fall, we have an opposite situation to a speculative bubble. Everyone wants in. And unless the Fed agrees to do what Bundesbank did for the Franc for the Euro, it will continue to fall until the markets decide otherwise and then the journalists and economists look for explanations of why it has now reversed. In the meantime, there is a lot of money to be made from selling the Euro and Sterling, irrespective of the threats from the FSA or the European Central Bank and governments. Circuit breakers do not work under any circumstance. They just create pent up energy that moves elsewhere, where it can transact. Given the size of the world’s FX market, and its liquidity, there is very little that such threats can do to stop the Euro and Sterling from falling.

The interesting part of this whole story is that had someone offered the European governments the opportunity to depreciate the Euro by 10% they would have happily said yes. But, now that they know it is the non-Euro-zone hedge funds, based in the U.S. and U.K., which could benefit from this exact similar action they are crying foul. Of course, they are also worried since they cannot control how much the currency could end up depreciating.

I am more than confident that this trend will continue, for the simple fact that the U.K.’s debt situation is much worse than many think, and that the Greek problems are simply the tip of the iceberg and once everyone realizes just how bad the situation is in Spain, Portugal, Italy and Ireland they will want to get out of the Euro as fast as possible.

As for the strengthening dollar, well I am sure that is the last thing that President Obama would have wished for. A strong dollar could slow down some of the recovery that we are witnessing. It would certainly make it harder to export U.S. goods and more attractive to import foreign goods, resulting in a further downward pressure on the U.S. inflation figures at a time they need some inflation, apart from the obvious balance of trade issues that the U.S. has. 2009 was a pretty bad year for many of his domestic agenda, but he was still living through a honeymoon period with Europe. Somehow I suspect that the Greek tragedy might turn it into the kind of honeymoon he was hoping to avoid.

Nessun commento:

Posta un commento