A good financial system is essential for a well-functioning economy. A good financial system allocates capital to its most productive use, and manages risk in ways that enable higher risk activities to be undertaken for higher return. By reducing risks faced by individuals and firms, e.g. through insurance products, a good financial system contributes to greater security and societal well-being, in ways that may not even be fully reflected in GDP statistics.

Another responsibility of the financial system is to run the payments mechanism, without which a modern economy could not function.

A good financial system does all of this efficiently, that is, at low transactions costs. It is essential to realise that, for the most part, the financial system is not an end in itself, but a means to an end, and the measure of the success of the financial system must therefore relate to its success in accomplishing these broader societal functions. Innovations in the financial system that help it perform these tasks better and at lower cost almost surely lead to increased societal well-being, and to the extent that our GDP measures capture these benefits, in higher measured growth. There are some financial innovations, such as the venture capital firms, that have facilitated the flow of funds to new enterprises. Few are questioning the virtue of these innovations.

The question about financial innovation is, however, somewhat different: it is whether most of the innovations that have been widely touted, such as credit default swaps, have in fact enhanced economic performance. What is evident is that they contributed to the current economic crises, and added greatly to the burden on taxpayers. The AIG bailout alone—linked directly to these innovations—cost taxpayers almost $180 billion, a sum that is hard to fathom. There is also ample evidence that they have been useful in accounting, regulatory and tax arbitrage, activities that may enhance the profits of the companies employing them, but not necessarily the efficiency of the economy. They have helped governments and firms hide their financial doings from taxpayers and investors. And those benefiting from such deception have been willing to pay amply for it, with large profits to the innovators, even if society as a whole loses.

Paul Volcker put the matter clearly when he said, "I wish that somebody would give me some shred of neutral evidence about the relationship between financial innovation recently and the growth of the economy."

I agree.(...)

We should not be surprised that the so-called innovation did not yield the real growth benefits promised. The financial sector is rife with incentives (at both the organisational and individual levels) for excessive risk-taking and short-sighted behaviour. There are major misalignments between private rewards and social returns. There are pervasive externalities and agency problems.

e conclude:

The right kind of innovation obviously would help the financial sector fulfil its core functions; and if the financial sector fulfilled those functions better, and at lower cost, almost surely it would contribute to growth and societal well-being. But, for the most part, that is not the kind of innovation that we have had.

Regulatory reform is important not just to ensure that the economy does not have another crisis. Better regulations, including regulations that help align private rewards and social returns, could and probably would direct the sector's creativity in ways that lead to more socially productive innovation.

La difesa dell'innovazione finanziaria è affidata a Ross Levine che scrive:

A me sembra che gli argomenti di Stiglitz siano un po' più circostanziati e meno ideologici, anche se non ne condivido l'enfasi sul sociale, forse perchè reso diffidente dall'(ab)-uso costante che ne vedo fare in Italia e in Europa. In generale il punto di vista di Levine è condivisibile ma le conclusioni sono deboli e non mi sembrano andare al cuore della questione.

Another responsibility of the financial system is to run the payments mechanism, without which a modern economy could not function.

A good financial system does all of this efficiently, that is, at low transactions costs. It is essential to realise that, for the most part, the financial system is not an end in itself, but a means to an end, and the measure of the success of the financial system must therefore relate to its success in accomplishing these broader societal functions. Innovations in the financial system that help it perform these tasks better and at lower cost almost surely lead to increased societal well-being, and to the extent that our GDP measures capture these benefits, in higher measured growth. There are some financial innovations, such as the venture capital firms, that have facilitated the flow of funds to new enterprises. Few are questioning the virtue of these innovations.

The question about financial innovation is, however, somewhat different: it is whether most of the innovations that have been widely touted, such as credit default swaps, have in fact enhanced economic performance. What is evident is that they contributed to the current economic crises, and added greatly to the burden on taxpayers. The AIG bailout alone—linked directly to these innovations—cost taxpayers almost $180 billion, a sum that is hard to fathom. There is also ample evidence that they have been useful in accounting, regulatory and tax arbitrage, activities that may enhance the profits of the companies employing them, but not necessarily the efficiency of the economy. They have helped governments and firms hide their financial doings from taxpayers and investors. And those benefiting from such deception have been willing to pay amply for it, with large profits to the innovators, even if society as a whole loses.

Paul Volcker put the matter clearly when he said, "I wish that somebody would give me some shred of neutral evidence about the relationship between financial innovation recently and the growth of the economy."

I agree.(...)

We should not be surprised that the so-called innovation did not yield the real growth benefits promised. The financial sector is rife with incentives (at both the organisational and individual levels) for excessive risk-taking and short-sighted behaviour. There are major misalignments between private rewards and social returns. There are pervasive externalities and agency problems.

e conclude:

The right kind of innovation obviously would help the financial sector fulfil its core functions; and if the financial sector fulfilled those functions better, and at lower cost, almost surely it would contribute to growth and societal well-being. But, for the most part, that is not the kind of innovation that we have had.

Regulatory reform is important not just to ensure that the economy does not have another crisis. Better regulations, including regulations that help align private rewards and social returns, could and probably would direct the sector's creativity in ways that lead to more socially productive innovation.

La difesa dell'innovazione finanziaria è affidata a Ross Levine che scrive:

Finance is powerful. As the last few years demonstrate, financial innovations can be used as tools of economic destruction. But the last few centuries demonstrate that financial innovation is crucial, indeed indispensable, for sustained economic growth and prosperity.

Financial systems provide vital services: they evaluate, screen and allocate capital, monitor the use of that capital, and facilitate transactions and risk management. If financial systems provide these services well, capital flows to the most promising firms, promoting and sustaining economic growth. Financial innovation—the creation of new securities, markets and institutions—can improve financial services and thereby accelerate economic growth.

Moreover, financial and technological innovations are inextricably bound together and evolve together, suggesting that financial innovation is essential for improving the wealth of nations. As described by Adam Smith, the very essence of economic growth involves increased specialisation and the use of more sophisticated technologies. The increased complexity makes it more difficult for the existing financial system to evaluate new enterprises or manage their novel risks. Thus, economic progress itself makes any existing financial system obsolete. Without a commensurate modernisation of the financial system, the quality of financial services falls, slowing economic growth.

e conclude:

Financial innovation, like all innovation, has risks, which have been unmistakably demonstrated by the current crisis. While government policies and regulators deserve ample blame for permitting, and even triggering, financial abuses, newly engineered financial products are undoubtedly woven into the tapestry of this crisis and past ones as well. The misuse of new products is not limited to finance, however. Information technology eases identity theft. Webcams facilitate child pornography. And, drugs are dangerously abused. But just as we should not conclude that medical research does not promote human health because of drug abuse, we should not conclude that financial innovation does not promote economic growth because of the devastatingly costly crisis through which we are now suffering.

Financial innovation is critical if we are to enjoy rapid rates of economic progress in the coming century, but innovation, change and growth can threaten stability. Improvements in financial regulation can reduce the risks of financial crises without curtailing sustained economic growth. In finance, as in medical research, encouraging the healthy application of human creativity requires some regulatory guideposts.

Financial systems provide vital services: they evaluate, screen and allocate capital, monitor the use of that capital, and facilitate transactions and risk management. If financial systems provide these services well, capital flows to the most promising firms, promoting and sustaining economic growth. Financial innovation—the creation of new securities, markets and institutions—can improve financial services and thereby accelerate economic growth.

Moreover, financial and technological innovations are inextricably bound together and evolve together, suggesting that financial innovation is essential for improving the wealth of nations. As described by Adam Smith, the very essence of economic growth involves increased specialisation and the use of more sophisticated technologies. The increased complexity makes it more difficult for the existing financial system to evaluate new enterprises or manage their novel risks. Thus, economic progress itself makes any existing financial system obsolete. Without a commensurate modernisation of the financial system, the quality of financial services falls, slowing economic growth.

e conclude:

Financial innovation, like all innovation, has risks, which have been unmistakably demonstrated by the current crisis. While government policies and regulators deserve ample blame for permitting, and even triggering, financial abuses, newly engineered financial products are undoubtedly woven into the tapestry of this crisis and past ones as well. The misuse of new products is not limited to finance, however. Information technology eases identity theft. Webcams facilitate child pornography. And, drugs are dangerously abused. But just as we should not conclude that medical research does not promote human health because of drug abuse, we should not conclude that financial innovation does not promote economic growth because of the devastatingly costly crisis through which we are now suffering.

Financial innovation is critical if we are to enjoy rapid rates of economic progress in the coming century, but innovation, change and growth can threaten stability. Improvements in financial regulation can reduce the risks of financial crises without curtailing sustained economic growth. In finance, as in medical research, encouraging the healthy application of human creativity requires some regulatory guideposts.

A me sembra che gli argomenti di Stiglitz siano un po' più circostanziati e meno ideologici, anche se non ne condivido l'enfasi sul sociale, forse perchè reso diffidente dall'(ab)-uso costante che ne vedo fare in Italia e in Europa. In generale il punto di vista di Levine è condivisibile ma le conclusioni sono deboli e non mi sembrano andare al cuore della questione.

L'ultima colonna di Buttonwood analizza l'impatto dei cambiamenti demografici sulle valutazioni degli asset e conclude:

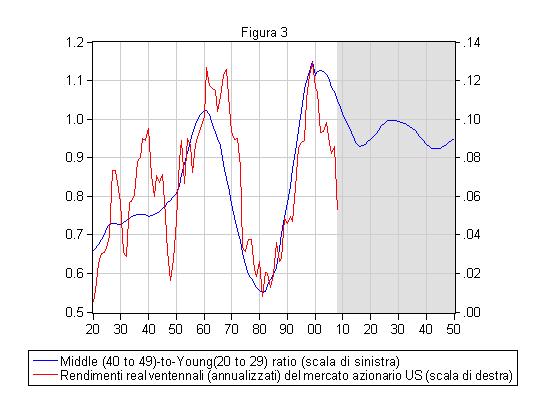

Are these preferences for asset classes driven by some underlying factor, rather as John Maynard Keynes argued that practical men were often slaves to the writings of some “defunct economist”? Tim Bond of Barclays Capital argues that demography may be to blame. The key “saving age” is the cohort of 35-54 year-olds. As they prepare for retirement, they pile into the asset class du jour. Mr Bond shows that since the second world war there has been a close correlation between American equity valuations and the proportion of 35-54 year-olds in the population. That the “noughties” proved to be a dismal decade for equities was hardly surprising. The number of retirees (who run down their portfolios) was rising relative to the number of savers.

The bad news is that the demographic maths imply that equity valuations will continue to fall until the middle of this decade. The news is even worse for government bonds. A similar model suggests that yields in both America and Britain are heading for 10% by 2020.

So demography drives investment fashion, and fashion determines valuations. In turn the long-term return is crucially dependent on the starting valuation. American equities now offer a dividend yield of just 2%, less than half the long-term average. Investors should remember that salutary statistic whenever they are tempted to get too bullish.

Qualche tempo fa avevo letto sull'argomento un post di Carlo Favero su noiseFromAmeriKa con toni un po' meno depressi: siccome sono diventato un inguaribile ottimista ve ne propongo le conclusioni

Cosa spiega la (cor)relazione tra la demografia e le flutuazioni dei rendimenti azionari?

Geanakoplos, Magill and Quinzii (2004, GMQ) offrono un potenziale risposta a questa domanda considerando un modello a generazioni sovrapposte in cui la struttura demografica riflette l'andamento delle nascite negli US, che sono state caratterizzate da periodi ventennali alternati di crescita e contrazione. GMQ studiano l'equilibrio di un'economia di scambio ciclica in cui si alternano tre generazioni: gli agenti prendono a prestito quando sono giovani, investono nella loro mezza età e vivono dei proventi dei loro investimentti da vecchi. In questa economia il rapporto dividendo/prezzo, cioè il rendimento di lungo periodo nell’investimento azionario, è proporzionale a MY

[MY (middle-to-young), cioè il rapporto tra la popolazione tra i 40 e i 49 anni (Middle) e quella tra i 20 ed i 29 anni (Young) negli Stati Uniti] . Un livello alto di MY spinge in alto i prezzi azionari perchè prevalgono nell’economia i flussi di investimento nel mercato azionario. In un lavoro recente Favero, Gozluklu and Tamoni (2009, FGT) analizzano le implicazioni empiriche del modello GMQ identificando econometricamente un equilibrio di lungo periodo per il rapporto dividendi/prezzi coerente con gli andamenti delle variabili riportate nella Figura 3. FGT illustrano come la media che si evolve lentamente nel tempo a cui tende il rapporto diviidendi-prezzi sia determinata da MY assieme ad un trend che coglie lo sviluppo della tecnologia. A conseguenza di questo fatto i trend demografici risultano molto significativi per la previsione dei rendimenti azionari nel medio-lungo periodo. Gli stessi trend demografici portano ad indicare, come si evince dalla Figura 3, un rendimento annuale reale medio attorno all’8 per cento per il mercato azionario nei prossimi venti anni.

[MY (middle-to-young), cioè il rapporto tra la popolazione tra i 40 e i 49 anni (Middle) e quella tra i 20 ed i 29 anni (Young) negli Stati Uniti] . Un livello alto di MY spinge in alto i prezzi azionari perchè prevalgono nell’economia i flussi di investimento nel mercato azionario. In un lavoro recente Favero, Gozluklu and Tamoni (2009, FGT) analizzano le implicazioni empiriche del modello GMQ identificando econometricamente un equilibrio di lungo periodo per il rapporto dividendi/prezzi coerente con gli andamenti delle variabili riportate nella Figura 3. FGT illustrano come la media che si evolve lentamente nel tempo a cui tende il rapporto diviidendi-prezzi sia determinata da MY assieme ad un trend che coglie lo sviluppo della tecnologia. A conseguenza di questo fatto i trend demografici risultano molto significativi per la previsione dei rendimenti azionari nel medio-lungo periodo. Gli stessi trend demografici portano ad indicare, come si evince dalla Figura 3, un rendimento annuale reale medio attorno all’8 per cento per il mercato azionario nei prossimi venti anni.

Nessun commento:

Posta un commento