L'opinione di Paul Krugman sulla questione (iper)inflazione/stagflazione è netta:

Hyperinflation is actually a quite well understood phenomenon, and its causes aren’t especially controversial among economists. It’s basically about revenue: when governments can’t either raise taxes or borrow to pay for their spending, they sometimes turn to the printing press, trying to extract large amounts of seignorage — revenue from money creation. This leads to inflation, which leads people to hold down their cash holdings, which means that the printing presses have to run faster to buy the same amount of resources, and so on.

The kind of inflation we had in the 1970s, the famous era of stagflation — high inflation combined with high unemployment — was quite different. Deficits weren’t the issue — actually, US deficits were much smaller in the inflationary 70s than in the disinflationary 80s. Instead, what you had was a combination of excessively expansionary monetary policies, based on an unrealistic view of how low the unemployment rate could be pushed without causing accelerating inflation (the NAIRU), plus oil shocks that pushed up inflation across the board thanks to widespread cost-of-living clauses in contracts. There was never any risk of hyperinflation; the only question was whether and when we’d be willing to pay the price in high unemployment of bringing inflation back down.(...)

Meanwhile, for those predicting hyperinflation, my question would be: what is it about the United States now that looks different to you from Japan in say, 2000? Big budget deficits and high debt? Check. Huge expansion in the monetary base? Check. And yet Japan’s GDP deflator has fallen 9 percent since 2000.

Gli fa eco Brad De Long su SeekingAlpha che aggiunge altre ragioni per non temere l'inflazione negli USA:

I would add:

- The people putting their money on the line in financial markets are really, really, really not expecting any inflation.

- The inflation bugs have been expecting an imminent rise in inflation within the year for two and a half years now--since the fall of 2007; thus there is something wrong with their analysis.

- If there were signs of inflation we would be in a much healthier situation--because people would then be trying to buy real assets rather than Treasury bonds with their money, and that would push demand up and unemployment down.

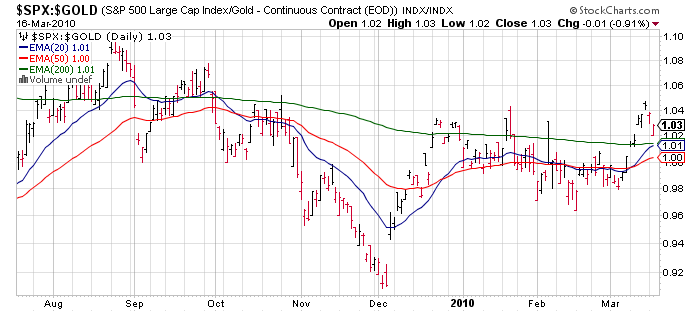

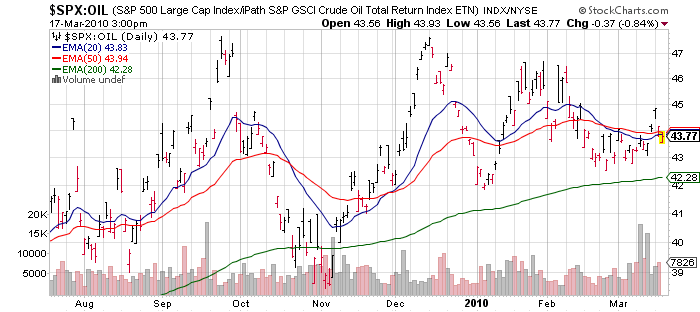

Comunque, se siete scettici e continuate a fare brutti sogni sull'inflazione, potete tenere d'occhio le materie prime e l'oro. Un modo divertente è seguire l'indice Dow Jones valutato in oro o in petrolio come in questo post dal quale ho preso i grafici che riproduco qui sotto

Ed ecco un grafico del rapporto Dow Jones / oro dal 1978 ad oggi

Nessun commento:

Posta un commento