Norway’s oil fund is debating the impact on its investment strategy of the “extraordinary” event of German, Danish and Swiss two-year bond yields all being negative.

Yngve Slyngstad, head of Norges Bank Investment Management, which has a market value of more than $600bn, agreed that seeing not just short-term bills but also two-year bond rates turn negative was a Through the Looking Glass moment.

“It is extraordinary. We are spending a lot of time thinking about what this is indicating. We have to ask the obvious question of why investors are paying for lending money and are not just keeping it in cash,” Mr Slyngstad told the Financial Times.

The negative two-year yields for the three European countries has been perhaps the most striking event in a historical year for bond markets with market interest rates hitting alltime lows in the US, UK and Germany.

Switzerland’s two-year bond yields are at -0.36 per cent, Denmark’s at -0.25 per cent and Germany’s at -0.07 per cent, meaning in effect that investors are willing to pay governments to be guaranteed the return of their money in two years.

Certo è un mercato bizzarro. Ma non c'è da stupirsi quando le azioni (e le inazioni) della politica dominano le considerazioni macroeconomiche. Voglio evitare di commentare in prima persona le polemiche e le discussioni degli ultimi giorni, così vi invito a leggere quanto scrive questa settimana John Mauldin:

Europe is quite the dysfunctional family, seemingly always on the verge of breaking up, but somehow managing to patch up the differences. We all have a family member (or two or three) who cause that sort of trouble. We watch the incessant squabbling with unease, wishing they would just settle things and move on. They never deal with the real issues, as that would mean facing too much personal angst and maybe even lead to an admission that the problem is not just with the other party. The euphoria of the initial relationship has been lost in the reality of day-to-day existence. Now, they either sort it out or break up.

These sorts of relationships devolve into co-dependency, where no one is happy. And the rest of us are liable to get sucked in. Even though it’s uncomfortable to be around these people, we still have to interact. But don’t you wish they would get some serious therapy?

And Europe was again acting out this week. First, Italian Prime Minister Mario Monti gave an interview to Der Spiegel, in which he warned of the disintegration of Europe if the European Union allows the euro to fail: “The tension which sprang up in the eurozone in recent years is beginning to look like Europe’s psychological disintegration.”

Remember, Monti was a compromise prime minister, brought in by a parliament wracked by chaos, in the wake of Berlusconi’s withdrawal. But alas, the latter party refuses to slink off quietly into the night with his billions and personal peccadilloes. Monti was appointed rather than elected and is a “technocrat” prime minister. Given the nature of Italian politics, he has done about as well as could be expected. He has an outstanding resumé and is part of the Europhile elite that defends the vision of a united Europe.

The interview itself was mostly the standard-issue political noise emitted from European centers of power. It would have gone unnoticed except for one little item. The Italian prime minister suggested that the heads of the EU national governments make decisionsindependently from their countries’ parliaments.

“If the governments are tied by their parliaments’ decisions, the lack of freedom of action will result in Europe’s breakdown, rather than deeper integration …”

Was the prime minister not listening to what he was saying? Let me paraphrase for him: “How can we keep the euro together if we have to listen to those pesky parliaments, elected by actual voters?” And he says this prior to the German Constitutional Court ruling on September 12, when most of the German leadership is treading lightly, assuming a “positive” outcome but knowing that nothing is certain? And he does this in one of Germany’s leading publications? Maybe there’s a reason he has never actually run for office. This bonehead statement must have chagrined even his most ardent supporters.

It certainly brought quick responses all over Europe, and especially in Germany.

“German politicians from across the spectrum have reacted furiously to warnings by Italy’s Mario Monti that Bundestag control over EU debt policies threatens to bring about the ‘disintegration’ of the European project. ‘We must make it clear to Mr. Monti that we Germans will not shut down our democracy to pay Italian debts,’ said Alexander Dobrindt, secretary-general of Bavaria’s Social Christians (CSU).” (Ambrose Evans-Pritchard, the Telegraph)

In the time-honored tradition of political spin and “clarification,” Mario Monti almost immediately went back before the press to insist that the words he spoke were not the ones he meant.

The Italian paper Il Libero ran a front-page photo of Angela Merkel, under the headline “The Fourth Reich.” And it gets a lot worse if you start looking.

But just to show off my own ecumenical nature, let me point out that German leaders have their own set of issues. Mainly, they simply have not told the German people what the costs of staying in the eurozone or leaving it are.

In past weeks we have looked at the two major options Europe faces. Let’s call them Disaster A and Disaster B. Disaster A ensues if they decide on a close fiscal union, which will entail giving up substantial national sovereignty (although it will not be sold that way to the voters). It would also mean that the northern states (Germany, the Netherlands, et al.) would have to shoulder large tax burdens in order to share with their southern neighbors and pay for the massive debts they have run up.

Of course, Germany helped create the problem, with its Landesbanks enthusiastically financing the various and sundry debt issues of the peripheral governments and their citizens. Note that when the German government revoked its guarantee of theLandesbanks (regional banks), their cost of borrowing rose significantly. The banks began to “reach for yield,” buying not only US subprime debt (which bankrupted a few of them) but also huge amounts of peripheral European sovereign debt.

The entire Greek bailout was really about using “European” taxpayer money to pay off German and French bank debts. Ditto for the other early bailouts. Now we are down to saving the euro (with the Spanish bailouts), which is an even more costly proposition.

Sidebar: ECB President Draghi famously remarked a week ago that he was prepared to do “whatever it takes” to save the euro, a message that was echoed by Merkel, Monti, and Hollande over the next few days. Then we found out, a week later, that “whatever” did not include using EFSF money to buy Spanish bonds (at least for now and until the German Constitutional Court ruling on September 12). Care to place a bet on what happens after that ruling? I bet there will be a compromise of some sort, to allow the EFSF or the ECB to fund. Draghi did say, after all, that he was simply waiting for a formal request before committing funds. And Spanish PM Rajoy is waiting until September 12, as well, perhaps because he wants to find out exactly what he will be agreeing to if he asks for help.

There is an unwritten rule in legal and political proceedings: never ask a question if you don’t already know the answer. If Spain asks for a bailout and then, for whatever political reason, cannot actually abide by the austerity rules, then that would be worse than not asking.

But it is not just northern (German) taxpayers who will be hurt. Southern-tier countries will have to endure serious austerity measures in order to get the money, which will mean even higher unemployment and deeper recessions – if not depressions. There is no free lunch.

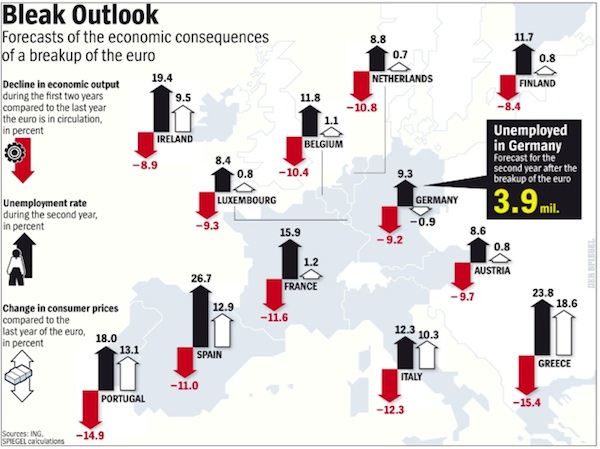

And then there’s Disaster B: the break-up of the eurozone, one way or another. Maine fishing buddy Josh Rosner included this graphic from Der Spiegel in a very impressive report he sent me on the cost to Germany of either leaving or staying in the euro (and which I posted here for Over My Shoulder subscribers). He demonstrates that it is actually much more costly for Germany to leave the euro. He also agrees with me that German leaders are not telling their people what the costs of either option are.

Note that no country does well in a break-up. But the outcomes vary, as some see serious inflation and others see deflation, while all see unemployment rise significantly.

I also note that 56% of Germans want their government to “do everything” to save the euro, with 76% saying a euro break-up would be bad for Germany. In addition, 64% of Germans believe the euro will survive, though 84% think the crisis will worsen, and 56% worry that the economy will deteriorate next year. Finally, 70% believe Merkel is doing a good job. (Source: Bloomberg, reporting on an ARD TV poll)

And Then There Is Disaster C

There is yet a third option that may be turning into the choice du jour. And that is, rather than opting in a straightforward manner for either fiscal union and a eurozone-wide backing of banks, etc., or a break-up of some sort, European leaders might do nothing more than deal with the problem immediately in front of them, moving from crisis to crisis in a slow-motion drift toward fiscal union.

To detail what a real fiscal union would mean and cost, you end up having to ask voters to approve something, and European leaders just don’t know what they will say. What if they say no, nein, non, não, ochi, nee, neen, cha toigh leam, or ei? There are so many ways to say “no” in Europe.

Which is why Mr. Monti is frustrated with the whole parliamentary process of dealing with the euro crisis. It all gets so very messy when you have to explain to voters exactly why and how much they should pay for your personal vision of their future. “If the governments are tied by their parliaments’ decisions, the lack of freedom of action will result in Europe’s breakdown, rather than deeper integration.” This is not unlike someone telling a Russian president to be patient because he will have more flexibility after the election. Just saying.

Ma forse la spiegazione sta nella difficoltà che da sempre gli anglosassoni hanno nel comprendere la profondità del pensiero degli europei, e degli italiani in particolare. Quindi è inutile preoccuparsi, tutto si aggiusterà in un modo o nell'altro, o almeno possiamo pensarla così fino al 12 settembre e poi stare a vedere cosa succede. Forse qualcosa renderà più vivace la vita monotona di uno speculatore di borsa

La strategia top2 questa settimana ha avuto un rendimento pari al +0,3%, la top3 ha fatto meglio con un buon +0,8%. Nel 2012 i rendimenti rispettivi sono stati finora pari al +10,4% e al +11,7%. Nel 2009 le stessa strategie avevano reso rispettivamente il 12.2% e il 2.4%, nel 2010 il 22.4% e il 18.2% mentre hanno chiuso negativamente il 2011 (-13,2% e -6,6%). Il rendimento composto annualizzato dal 1 gennaio del 2009 ad oggi è rispettivamente pari a +8,0% e +6,6% con massimo drawdown 16,9% e 15,1% e volatilità 11,3% e 10,8%. Negli ultimi dodici mesi entrambe le strategie sono state considerevolmente meno volatili: la volatilità della top2 è stata del 7,7% e quella della top3 un tranquillo 7,0%.

La strategia che investe negli asset con tendenza di medio periodo positiva questa settimana ha chiuso in positivo +1,1%. Nel 2012 il rendimento finora è stato pari al +6,8%. Positivo il 2009 +11,7% e il 2010 con un rendimento pari al +12.1% leggermente negativo invece il 2011 con un -3,3%. Il rendimento composto annualizzato dal 1 gennaio del 2009 ad oggi è pari al +7,4%, con un massimo drawdown del 9,2% e volatilità 10,2%.

La tabella qui sotto riassume il profilo rischio/rendimento delle tre strategie negli ultimi 3 anni:

Nella figura è raffigurato l'andamento di un euro investito nelle tre strategie dal 3 gennaio 2009 ad oggi.

E' bene ricordare che i rendimenti calcolati non tengono neppure conto dei costi di transazione e del prelievo fiscale. Mi preme comunque sottolineare che le analisi e le simulazioni descritte in questo blog sono da considerarsi sempre e comunque risultati teorici e relativi al passato. Chiunque decidesse di utilizzare le strategie descritte o qualsiasi altra informazione tratta da questo blog per decisioni di investimento se ne assume completamente la responsabilità.

Quattro asset hanno la tendenza di medio periodo positiva: le obbligazioni trentennali dell'eurozona, le azioni U.S.A., l'indice immobiliare globale e le azioni europee. Tutti gli asset hanno la tendenza di breve periodo tranne il cambio euro/dollaro, nuovamente in discesa dopo il rimbalzo della scorsa settimana.

Invariato il portafoglio della strategia top2 che dividerà il capitale in due parti uguali tra l'indice immobiliare globale e le obbligazioni governative dell'eurozona. Invariato il portafoglio della strategia top3 che investe il capitale dividendolo per 1/3 nell'indice SP500, per 1/3 nelle obbligazioni trentennali dell'eurozona e il rimenente 1/3 nell'indice immobiliare globale. Invariato il portafoglio della strategia che investe negli asset che hanno una tendenza di medio periodo positiva e che divide il capitale in quattro parti uguali tra l'indice immobiliare globale, l'indice SP500, le obbligazioni trentennali dell'eurozona e l'indice Eurostoxx.

In questo post trovate le risposte ad alcune delle domande più frequenti relative alla metodologia che utilizzo per la costruzione della tabella e dei portafogli che aggiorno settimanalmente.

In questo post ho descritto quali ETF negoziati a Milano replicano (in positivo o in negativo) gli indici che sono settimanalmente tracciati qui su Alfaobeta. Se volete fare delle analisi da soli, in questo post ho spiegato come procurarsi gratuitamente le serie storiche dei prezzi e dei NAV degli ETF mentre qui potete trovare qualche informazione sui costi di transazione nel mercato dei cambi.

Ecco l'aggiornamento al 10 agosto 2012.

Nessun commento:

Posta un commento